Do I Have Enough Money Saved for Financial Preparedness?

Yesterday, we reviewed the three questions you should ask yourself when checking your Financial Preparedness Score. Now that you have an idea of where you are in your emergency financial preparedness plan let’s dive into the first checkpoint: how much money you should have in savings for emergencies.

According to a recent survey, more than half of American households have less than $1,000 in their savings accounts. On the other hand, the average mortgage payment is $758, and the average debt per household is $131,431. In the event of an earthquake or another natural disaster, your financial obligations do not go away. If your nest egg isn’t much more than one or two months of paying your mortgage, you may want to reconsider what you need.

In addition to your mortgage and living expenses, you may not be able to work or have new bills after the natural disaster. For this reason, an emergency savings fund will help maintain life as “normal” as possible after a disaster. An emergency savings fund can also help with those unexpected costs and loss of income.

How much money do I need in savings for emergency preparedness?

Considering its importance, you may be ready to start saving. First, you’ll need to sit down and look through your average monthly expenses for the last three months to find:

- How much money do we spend per month on living expenses?

- How much money do we have left over each month after paying these living expenses?

Remember, these are basic living expenses, such as electric bill, mortgage or rent, and money for food. An emergency fund is not for buying a new car or taking a vacation. Next, with this in mind, determine how much money your household needs to survive for three to six months. Your emergency savings fund goal will be equal to three to six months of living expenses.

We recommend building your emergency savings fund at a pace that best fits your needs. Look at how much money you have left over at the end of the month after you have paid your necessary living expenses. This figure will help you get a plan to build your savings at a comfortable pace. When you think about your savings like a bill (except the money is owed to yourself), you can start to think about how building your emergency fund can fit into your overall financial obligations.

What’s the next step?

If you’re feeling pretty confident about your emergency fund, don’t get too comfortable yet. You need to check your insurance coverage for holes or exclusions so that you’re not stuck with a massive bill you can’t cover. In the next part of this series, we will cover the basics of insurance and how it can help cover some of your more substantial expenses after an emergency.

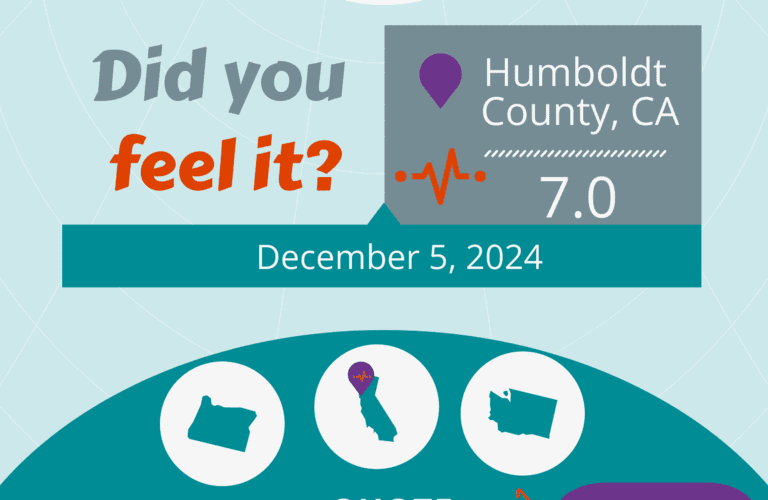

Have you protected your home with earthquake insurance? Visit our site today to get a free quote or find an agent in California, Oregon, or Washington.