Today we are rattling off about the shaky subject of earthquake insurance. We touched on this a little bit in our Financial Preparedness series, including best earthquake insurance practices, but we are going to go a bit more in-depth on for this update.

One of the most commonly asked questions is, “Do I need earthquake insurance?”

The answer is not simple. Just like your house isn’t like everyone else’s, what to expect from an earthquake insurance policy (or even your homeowners insurance policy) is unique to your situation. Hopefully, after reading, you’ll have a better understanding of what to consider when shopping for earthquake insurance.

Who needs earthquake insurance?

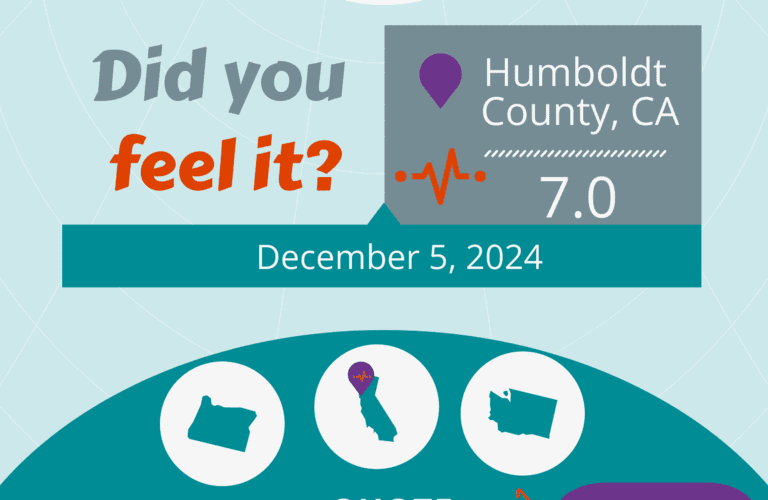

It really depends on you. Earthquake insurance coverage isn’t required by your lender or by the state. Technically, all fifty states in America are at risk for earthquakes, but there are some states where earthquakes are more likely, more frequent, or more powerful. Opens a new window If you live in one of these states, like Washington, Oregon, or California, the decision to get earthquake insurance should be carefully considered.

You’re well aware of the risks that come with living in one of these Western states. Look anywhere–social media, the news, a quick Google search–and you’ll quickly see how frequent seismic activity is, even if you don’t always feel the quake.

One massive earthquake can be devastating. Earthquake prep usually brings to mind preparing for physical safety, but not as many people remember the financial recovery.

Small earthquakes may not be much to worry about, but one moderate-to-large sized earthquake can be devastating enough to do some costly damage to your home. That’s where insurance makes a difference.

Do I need earthquake insurance?

Earthquake insurance, just like any insurance policy, functions as a way to cover the cost of something you wouldn’t usually pay for out of pocket.

Here are the most important factors to consider:

- You own a home in a region that is prone to property damage due to earthquakes.

- Your Homeowners insurance does not cover earthquake damage.

- Your home equity is growing.

- You need your retirement savings.

- The federal government will not bail you out.

- If you have a total loss, you still have to pay your mortgage and find a place to live.

Most likely, you’re counting on your equity to be a significant investment for your finances and you should give earthquake insurance a serious thought.

Where do I get earthquake insurance?

Even if you can find a Homeowners insurance provider that also provides Earthquake insurance, it is wise to shop around and check all of your options.

In California, you can purchase coverage through the California Earthquake Authority, but there are some drawbacks as discussed below. Another option to consider is a private stand-alone Earthquake insurance provider. With a stand-alone Earthquake insurance policy, you can combine superior Earthquake insurance with your top choice of Homeowner’s insurance.

Choosing an earthquake insurance carrier requires a bit of research, but the benefits are considerable when you secure something that fits your lifestyle and your budget.

Does my homeowners insurance provider offer earthquake insurance?

Some homeowners insurance carriers either don’t like to write earthquake insurance business or aren’t well-designed to handle the risk. Those carriers will price their earthquake insurance policies accordingly, and you might end up paying more for a less specialized or lower-rated provider.

Likewise, their experience with catastrophic-risk claims is limited. Not only do some homeowners insurance carriers design and rate their earthquake policies to reflect their reluctance, but they may also structure their claims process like their homeowners claims process.

Natural disasters like earthquakes can impact large areas all at once, so this means potentially a huge influx of claims of various amounts will hit the homeowners insurance carrier at the same time. In some cases, this can overwhelm an insurance carrier that doesn’t specialize in this type of insurance.

For these reasons, your homeowners insurance carrier may not offer the best deal for you, so be sure to look around and carefully consider all of your options before settling on this one.

State Earthquake Insurance Providers

A second place to check for earthquake insurance is state-managed groups. In California, residents can purchase coverage through a privately funded but publicly managed provider, the California Earthquake Authority, or CEA. In order to be eligible for a CEA policy, one must be a policyholder of a participating Homeowners provider.

It is important to note that a CEA policy is not backed by the CA Guarantee Association, and may have limited claims paying ability after a major event.

Private Stand-Alone Earthquake Insurance Provider

A third place to check for earthquake insurance is a private stand-alone earthquake insurance provider. In California, Oregon, and Washington, residents can secure earthquake insurance coverage through GeoVera Insurance Company Opens a new window, Coastal Select Insurance Company Opens a new window, and several other carriers.

These carriers specialize in earthquake risk and are subject to the same guidelines, financial reviews, and operational standards of homeowner insurance carriers.

QuakeInsurance offers earthquake insurance only through the highest-rated and longest-tenured Earthquake insurance providers in California, Oregon and Washington.

How Do I Choose an Earthquake Insurance Policy?

Not all Earthquake insurance policies can be compared apples to apples. It is essential to shop around, get quotes from various providers, and look at the coverage details carefully. Not only should you look at the premium, but read to see what you’re getting with your coverage limits and the deductible and if it will work for you in the event of an earthquake.

Here are the most important factors to look at when shopping for Earthquake insurance:

- Look for an insurance provider rated “A” (Excellent) by A.M. Best. This guarantees the financial strength of the company.

- When comparing prices, look to see if the policy includes coverage for Other Structures, Contents, Loss of Use and Loss Assessment.

- Look for a wide range of deductibles to choose from. QuakeInsurance by GeoVera offers deductibles from 2.5% – 25% in most areas.

- Look for a provider that has proven experience managing claims during devastating natural disasters. QuakeInsurance only works with providers that are experts in catastrophe claims management.

If you’re not sure what you need or you want a second opinion, call a licensed QuakeInsurance representative at 1 (800) 324-6020 Opens a new window.

You’ll want QuakeInsurance by GeoVera on your side when the next quake strikes. Get a quote today!