A Stand-Alone Earthquake Policy is a specialized insurance policy that covers damages caused by earthquakes and related events. It is separate from standard homeowners’ insurance and offers comprehensive protection to homeowners living in earthquake-prone regions, which can be beautiful and nerve-wracking.

This is where earthquake insurance steps in to provide much-needed protection. Quake Insurance by Geovera offers comprehensive stand-alone earthquake policies that ensure peace of mind during seismic events.

How does earthquake coverage work?

Unlike standard homeowner’s insurance policies, earthquake insurance is specifically designed to cover damages caused by earthquakes and related events. The policy provides financial assistance to repair or rebuild your home and replace belongings damaged during an earthquake. This coverage may also extend to additional structures on your property, such as garages or fences.

What is a good deductible for stand-alone earthquake insurance?

The earthquake insurance deductible refers to the amount you need to pay out of pocket before your policy starts covering the remaining costs. Determining the right deductible involves balancing your risk tolerance with the goal of securing affordable earthquake insurance. Quake Insurance by Geovera calculates earthquake insurance deductibles using the property value. Higher property values generally correspond to higher deductibles.

It’s crucial to find a balance between affordability and coverage. While a higher deductible can lead to lower premiums, it could burden you with substantial upfront costs after an earthquake. On the other hand, a lower deductible might result in higher premiums, but it ensures more manageable expenses when making a claim.

What should stand-alone earthquake insurance cost?

The cost of earthquake insurance varies depending on several factors, such as your property’s location, construction type, age, and the coverage limit you choose. Quake Insurance by Geovera offers affordable earthquake insurance policies tailored to your unique needs. By evaluating the seismic activity in your area and your property’s vulnerability to earthquakes, Quake Insurance by Geovera provides competitive premiums without compromising coverage.

With their extensive expertise in earthquake insurance, Geovera ensures that homeowners receive the protection they need at a price that fits their budget.

How do I know if I should get stand-alone earthquake insurance?

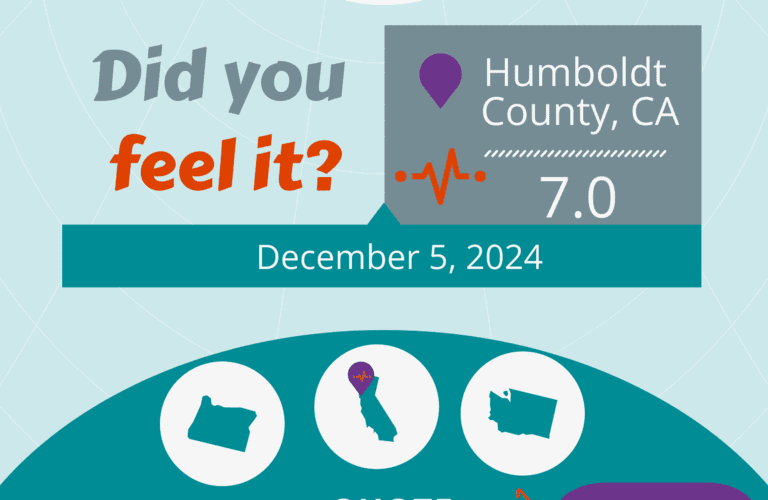

Determining whether you should get earthquake insurance requires careful consideration of your location and the level of risk you face. If you live in a seismically active area, the chances of experiencing an earthquake and its potential damage to your property are higher.

Geovera’s stand-alone earthquake policy offers peace of mind and protection, especially for homeowners residing in earthquake-prone regions. Even if your area experiences minor tremors or quakes infrequently, a single significant earthquake can lead to substantial losses. Investing in earthquake insurance safeguards your finances against the unforeseen and provides reassurance during uncertain times.

Do homeowners insurance policies cover earthquakes?

Standard homeowners’ insurance policies usually do not cover earthquake-related damagesOpens a new window. This is why a stand-alone earthquake policy is essential. Homeowners insurance policies typically exclude coverage for damages caused by earthquakes, floods, and other natural disasters.

To ensure comprehensive protection, you can opt for earthquake endorsement coverage, which adds earthquake coverage as an add-on to your existing homeowners’ insurance. However, evaluating whether an endorsement provides sufficient coverage for your needs is essential or if a stand-alone earthquake policy would be more suitable.

Want to get a fast and easy quote for your property? See the best options for earthquake insurance for your property in less than a minute.