Conditions in California are ever changing. The state is in the midst of a winter filled with record snow and rainfall. Are you prepared for these unprecedented events’ impact on your home and property? Californians are used to drought warnings, not flooding. Due to climate change, what we have always accepted as the level of risk might not be the actual risk today, with recent floods being the example.

Can you afford to lose all the equity in your house? What happens to your household and your financial future if the unexpected happens? Be prepared!

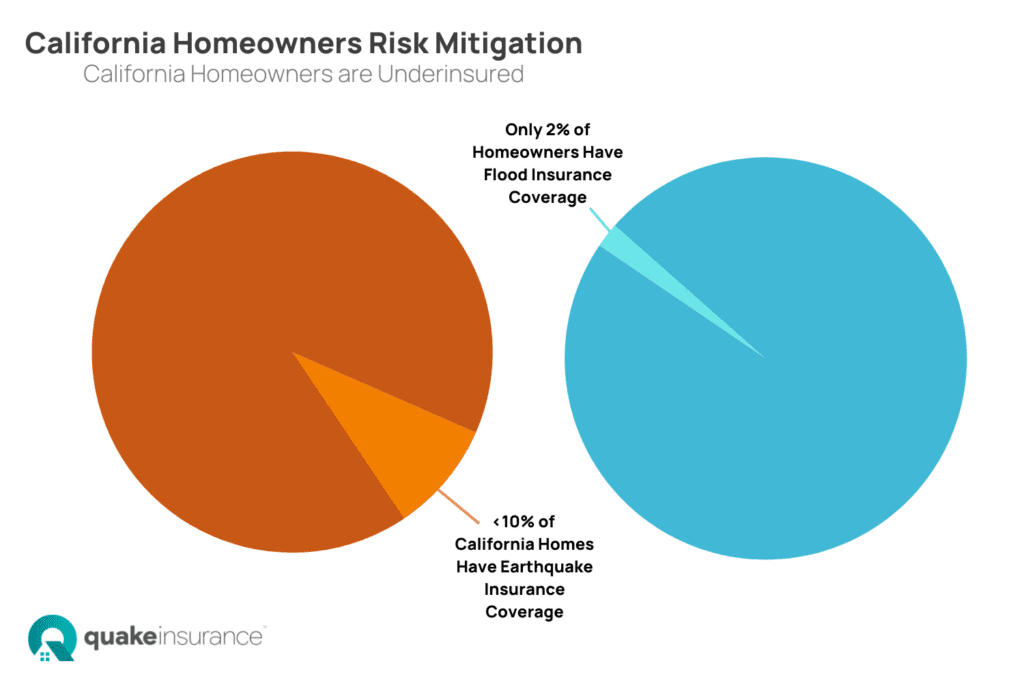

On March 10, a breach in a levee in the agricultural town of Watsonville, CA, opened thousands of homeowners’ eyes to the unexpected risk of flood, even outside the traditionally mapped floodplains. According to PBS, only 2% of homeowners have flood insurance policies. And as the Spring approaches, living in the shadow of a melting monumental snowpack may leave many more homeowners in peril.

There is a similar trend with earthquake insurance, which is also sold as a separate policy from homeowners. As less than 10% of California homes are insured for earthquake damage. The key is that losses from either peril are not covered by a homeowners’ policy. Meanwhile the government does not require these separate coverages for all homes, so most homeowners opt not to cover themselves for flood or earthquake damage taking a big risk with the largest asset they own.

Californian Homeowners are Underinsured for Earthquake & Flood Damage

Do I Need Earthquake or Flood Insurance?

Here are the most important factors to consider when deciding if you need earthquake or flood insurance:

- You own a home in a region that is prone to property damage due to earthquakes or flood.

- Your Homeowners insurance does not cover earthquake or flood damage.

- Your home equity is growing.

- You need your retirement savings.

- The federal government will not bail you out.

- If you have a total loss, you still have to pay your mortgage and find a place to live.

Most likely, you’re counting on your home equity to be a significant investment within your personal balance sheet, and you should give earthquake and flood insurance a serious thought to protect this key asset.

To learn more about flood insurance and how it works, visit the California Department of Insurance website.

If you’re not sure what you need, or you want a second opinion on earthquake coverage, call a licensed QuakeInsurance representative at (800) 324-6020 or go online for a quote. You’ll want QuakeInsurance by GeoVera on your side when the next quake strikes. Get a quote today!